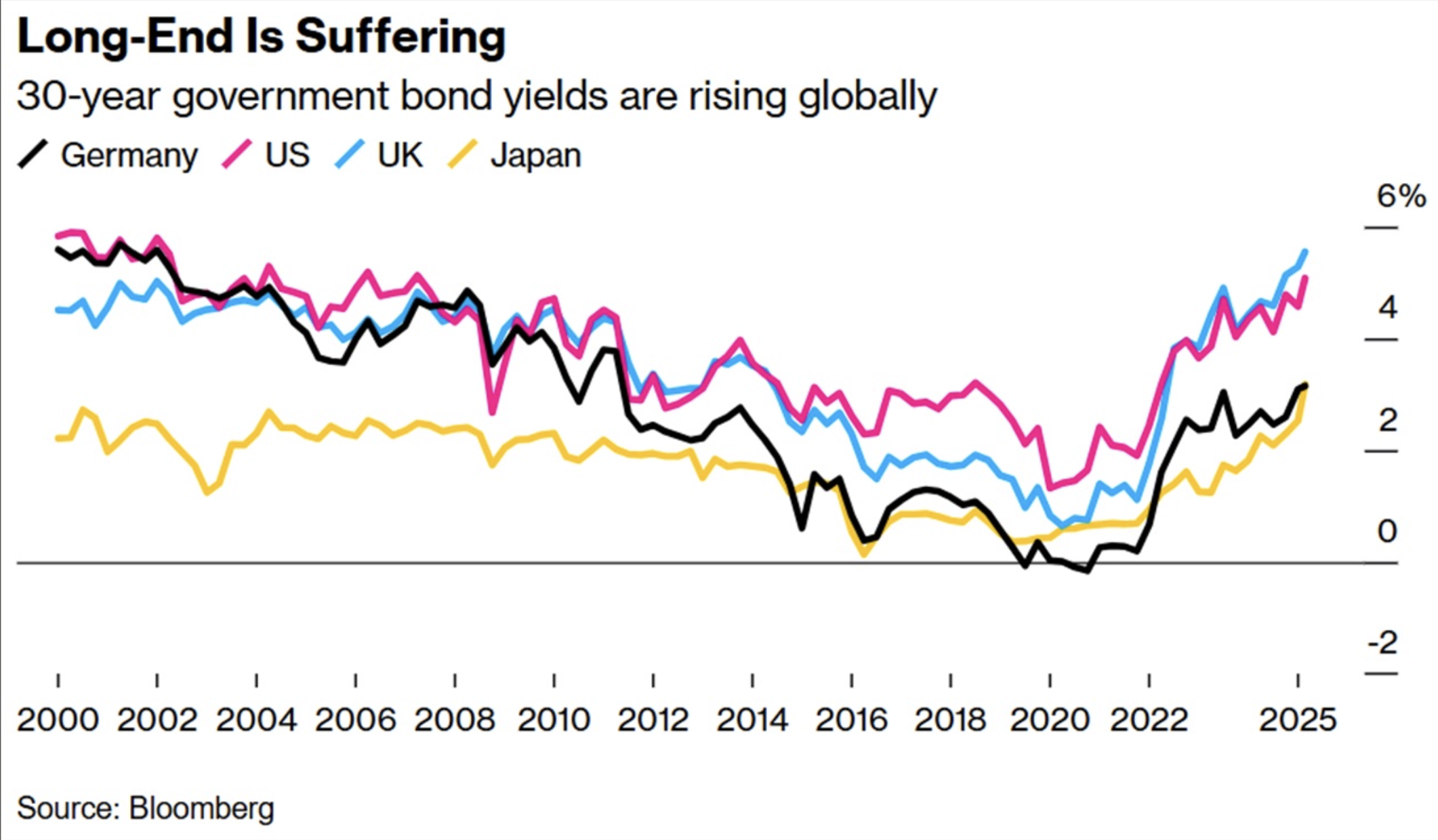

Global bond markets are undergoing a structural shift, as yields on government debt climb to multi-year highs. In the US, rising Treasury yields are forcing a reassessment of fiscal policy, with investors demanding higher returns to absorb ballooning issuance. The yield on 10-year Treasuries has remained persistently elevated, reflecting concerns over long-term deficits, inflationary pressures, and the scale of refinancing costs ahead. Moreover, with the ‘big, beautiful’ tax bill being pushed by the Trump administration – comprised of significant tax cuts and large government spending – many investors are worried about the spectre of accumulating long-term debt.

Elsewhere in Asian markets, Japan is seeing faltering demand for long-dated bonds, prompting talk of a pivot towards shorter maturities. These adjustments seem to be ushering in a new phase in the global debt cycle. Central banks may have paused their hiking campaigns, but investors no longer assume that rates will stay low indefinitely. The implications are significant: fiscal space is narrowing, refinancing is becoming costlier, and the old assumption that demand for sovereign debt is endlessly elastic is beginning to crack. Bond markets are no longer immune to the currents of economic policymaking.