“Neither a borrower nor a lender be” advised Polonius to his son Laertes in Shakespeare’s Hamlet. Similarly, in The Merchant of Venice, Antonio borrows from the moneylender Shylock, pledging a pound of flesh as collateral. Shakespeare’s works reflect the enduring moral ambiguity of debt, portraying it as both a necessary instrument and a burdensome risk. This finds parallels In the modern era, where government debt has surged to unprecedented levels, driven in part by technological advancements that have accelerated financial transactions, including large-scale lending. The UN reports that debt has surged to £97tn globally with a disproportionately large percentage of this being from developing countries. While debt can provide a crucial lifeline to kick-start a development journey, it often comes at a steep price. For instance, China’s loans to Africa are contingent on rights to extract their natural resources and debt servicing costs equivalent to 8% of government revenue (UN, 2024).

In advanced economies, government borrowing has been essential in funding critical medical research, developing vaccines, bulk buying protection gear, and protecting workers from post-pandemic involuntary unemployment. However, managing an ever-increasing debt burden remains a significant challenge. In contrast to historical approaches such as the post–2010 austerity measures in the UK following the Global Financial Crisis (IFS, 2024), today’s policymakers face limited fiscal manoeuvrability in addressing escalating debt without stifling economic recovery.

Tightening the Purse Strings: Fiscal and Monetary Strategies in the UK

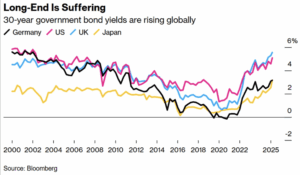

Fiscal and monetary tightening are key policy tools used to curb inflation and manage debt sustainability, though this inevitably results in slower economic growth. Fiscal tightening involves raising taxes or reducing government spending, while monetary tightening includes increasing interest rates and contracting the money supply. In 2022, the UK implemented quantitative tightening, with the Bank of England selling £80bn worth of gilts in order to reduce excess liquidity in the financial system and contain inflationary pressures. However, this policy created unintended consequences: the increased supply of bonds drove down prices, pushing yields higher (as the fixed coupon rate is divided by the price). This, in turn, fed through to higher interest rates in the form of higher borrowing costs across the economy. As a result, any new debt which was issued by the government became more expensive to service over time. Consequently, given these challenges, policymakers increasingly turn to fiscal tightening as an alternative, though this approach also carries economic trade-offs (Bank of England, 2023).

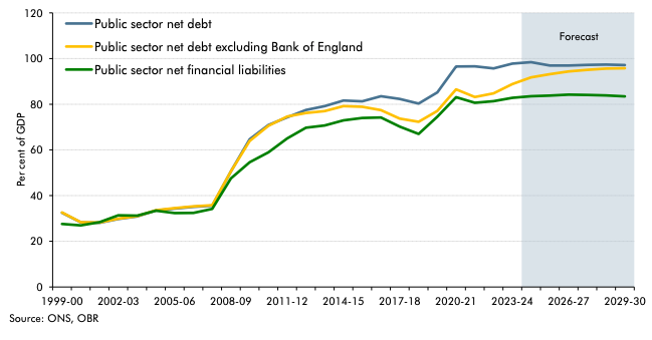

| UK Public Sector Net Debt |

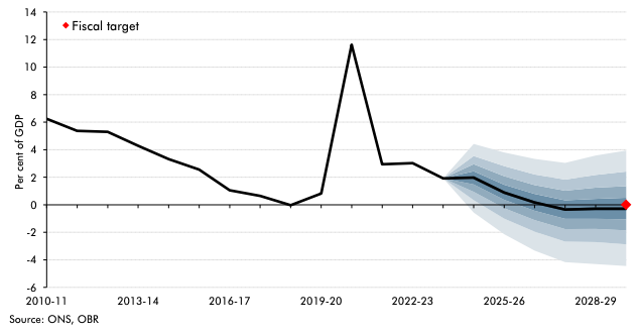

| UK Budget Deficit |

The UK’s national debt is primarily measured through public sector net financial liabilities, a broader measure than the previously used public sector net debt, now adopted by Rachel Reeves, Chancellor of the Exchequer as an indicator of fiscal stability. This ratio reflects the principal on outstanding debt plus regular interest payments as a share of GDP, In contrast, the budget deficit represents the gap between public sector spending and income from tax receipts over a given period of time (Institute for Government, 2024). In August 2024, public sector net debt stood at 100% of GDP – 3.4 percentage points higher than at the end of August 2023 – reaching levels last seen in the early 1960s. Meanwhile, the budget deficit hit £13.7bn in the same year, marking the third-highest August borrowing figure since monthly records began in January 1993 (ONS, 2024). These alarming statistics are compounded by a further issue raised by Rachel Reeves’ regarding a £22bn “black hole” in public finances, reportedly concealed by the previous Conservative government (Financial Times, 2024). Unmanaged debt is a recipe for disaster, leading to a decline in the UK’s credit rating, a loss of investor sentiment, and higher borrowing costs as yields on future debt spikes. Given this precarious outlook, what policy options remain open for the UK government?

Labour’s Fiscal Strategy

During his campaign, Keir Starmer restricted his fiscal headroom by pledging not to raise high-volumetaxes affecting “working people”; namely VAT, National Insurance, and Income Tax, the three largest contributors to the government pot of tax revenue. As a result, the Autumn budget introduced other fiscal measures to address spending commitments while offsetting £236 billion of student loan debt against national debt (Reuters, 2024). Day-to-day departmental spending is set to increase by 2% annually, likely widening the budget deficit. Employer National Insurance Contributions (NICs) will rise by 1.2 percentage points to 15%, inheritance tax will apply to unspent pension pots, and Capital Gains Tax will see increases, with the lower rate rising 10% to 18%, and the higher rate increasing from 20% to 24% (HM Treasury, 2024).

These tax changes target those with the “broadest shoulders” such as second home-owners, or executives. However, these groups constitutes a small fraction of the population, raising concerns about the effectiveness of these measures in generating substantial revenue. Standard economic theory suggests that tax rises on wealthier individuals often instigates capital flight, as firms and individuals relocate to lower-tax jurisdictions, mobilise assets offshore, or employ legal mechanisms to minimize tax liabilities – a trend observed during the tax hikes of the 1960s. In contrast to George Osborne’s austerity policies, which significantly reduced departmental spending, Rachel Reeves’ fiscal strategy includes planned spending increases. This approach remains contentious, especially amid mounting concerns over bureaucratic expansion and a perceived lack of accountability within government. Additionally, the National Health Service (NHS) continues to struggle with overwhelming backlogs and extended waiting lists, exacerbated by COVID-19 and recent waves of industrial action (BMA, 2024). Given these constraints, questions arise over whether higher public spending will translate into meaningful improvements in service delivery or merely deepen fiscal pressures.

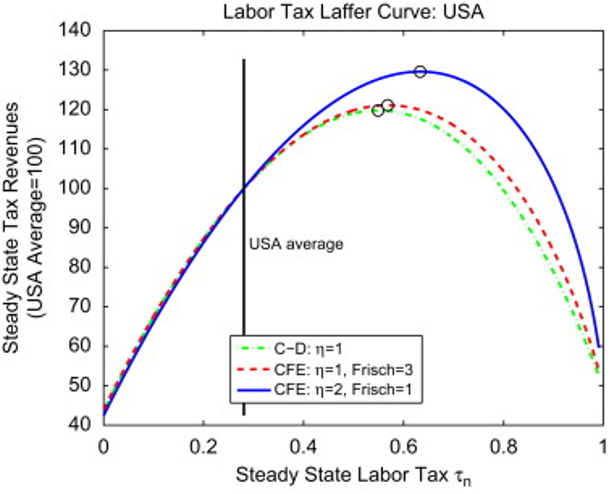

The Laffer Curve in Action: Taxation in the US

Shifting focus to the United States, the debate over taxing the general population as opposed to the top 1% is closely tied to the Laffer Curve – a theory developed by Arthur Laffer, an economic advisor to Richard Nixon, Ronald Reagan and Donald Trump. The curve suggests that there is an optimal rate of tax that maximises government revenue before higher taxes begin to discourage economic activity and reduce overall collections.

In a recent interview with the Financial Times, Laffer advocated for a broad and low-rate tax base, arguing that this approach reduces loopholes, lowers capital flight, and promotes long term growth. He contends that expanding the tax base – rather than targeting the wealthy – would have a marginal impact on individual taxpayers while generating substantial entrepreneurial effects to offset the 6% budget deficit in the US. Moreover, Laffer critiqued the Biden administration’s fiscal policy, arguing that excessive overspending on welfare/transfer payments had been inflationary. Instead, he advocates for monetary loosening through the purchase of long-dated government bonds to stimulate the economy. However, such an approach raises significant concerns about its potential impact on poverty and income inequality (Financial Times, 2024).

An increase in government expenditure may be necessary to enable economic growth, as rising GDP expands the denominator of debt-to-GDP ratios, improving fiscal sustainability. However, at the other extreme, the economic approach often associated with “Trumpanomics” – characterised by aggressive tax cuts and protectionist trade policies projected to raise global import costs – could have destabilizing consequences both domestically and abroad. Projected tax cuts and trade barriers are expected to drive up global import costs, fuelling inflation and intensifying trade frictions. Furthermore, in a country with high income inequality, evidenced by a Gini coefficient of 0.47, inflation would further erode purchasing power, disproportionately impacting lower-income households. Since poorer individuals allocate a greater share of their income to necessities, which tend to experience higher inflation rates, the effects would be regressive, worsening economic disparities. Additionally, US Debt is expected to spiral by $350bn annually (Economist, 2024). These challenges are compounded by the Federal Reserve’s recent and unexpected decision (at the time of writing) to raise the federal funds rate from 4.75% to 5%, significantly increasing cost of newly issued debt,. This poses a fiscal dilemma as the US, alongside the rest of NATO, ramps up military assistance for Ukraine (Trading Economics, 2024).

A Perpetual Policy Paradox?

Whether it is the UK or the US, navigating fiscal sustainability requires a delicate balance between necessary public spending and market confidence. While fiscal expansion is often necessary during public health and financial crises to prevent economic collapse, its long-term viability hinges on the government’s ability to reassure markets of its debt-servicing capacity. Without this confidence, borrowing costs rise, investor sentiment weakens, and fiscal tightening becomes inevitable – whether through austerity in the UK or higher interest rates in the US. As both nations grapple with record-high debt levels and persistent inflationary pressures, policymakers once again face a policy paradox: financing critical public investment without undermining economic stability.

Works Cited:

United States Effective Federal Funds Rate [Online]. Trading Economics. https://tradingeconomics.com/united-states/effective-federal-funds-rate. [Accessed 28/02/2025].

UN (2024). A World of Debt: Report 2024 [Online]. Available from: https://unctad.org/publication/world-of-debt#:~:text=This%20is%20what%20is%20happening,fast%20as%20in%20developed%20economies. [Accessed 28/02/2025].

Dave Ramsden (2023). Quantitative Tightening: The Story so far [Online]. Bank of England. Available from: https://www.bankofengland.co.uk/speech/2023/july/dave-ramsden-speech-on-quantitative-tightening-chaired-by-money-macro-and-finance-society. [Accessed 28/02/2025].

Emmerson, Johnson, Ridpath (2024). The Conservatives and the Economy, 2010-24 [Online]. IFS. Available from:https://ifs.org.uk/publications/conservatives-and-economy-2010-24. [Accessed 28/02/2025].

Public Sector Finances, UK (2024). Public Sector Finances: UK, 2024 [Online]. ONS. Available from: https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/bulletins/publicsectorfinances/december2024#:~:text=central%20government%20debt-,The%20interest%20payable%20on%20central%20government%20debt%20was%20%C2%A38.3,it%20was%20%C2%A317.6%20billion. [Accessed 28/02/2025].

Uddin R, Dunkley E, Mason-Myhill L (2024). UK executives dump shares on fears of Labour capital gains tax raid [Online]. Financial Times. Available from: https://www.ft.com/content/e95bae86-7c43-4241-a98e-ba6064a6a387?accessToken=zwAGJDE0zq-wkdPpW66GfENCQdOpjrpgZKajhw.MEUCIQDLC34WQKywd93e5jBl611cWGIPYdK-qWKF92Z4JnUvJwIgZQo22OGWalcGFD2vfx9uEfH2Dd9hH_aSgqQSgbIe_V8&sharetype=gift&token=c24b0c7f-f7ff-451b-b3c2-7e13e8a1c728. [Accessed 28/02/2025].

Milliken (2024). Reeves to Change Debt Target to Boost Public Investment [Online]. Reuters. Available from: https://www.reuters.com/world/uk/uks-reeves-says-she-will-change-government-debt-rules-boost-investment-2024-10-24/. [Accessed 28/02/2025].

HM Treasury (2024). Autumn Budget 2024 [Online]. Gov.uk. Available from: https://www.gov.uk/government/publications/autumn-budget-2024. [Accessed 28/02/2025].

NHS Delivery and Workforce (2024). An NHS Under Pressure. BMA. Available from: https://www.bma.org.uk/advice-and-support/nhs-delivery-and-workforce/pressures/an-nhs-under-pressure#:~:text=The%20NHS%20is%20experiencing%20some,pressure%20points%20in%20the%20NHS. [Accessed 28/02/2025]

Giles C (2024). Supply-Side Guru Arthur Laffer hails Trump’s Tax Policy [Online]. Financial Times. https://www.ft.com/content/8cb63288-bc85-11e6-8b45-b8b81dd5d080. [Accessed 28/02/2025].

Gundlach J (2024). America’s Debt Cannot Keep Stacking Up [Online]. Economist. https://www.economist.com/by-invitation/2024/12/13/americas-debt-cannot-keep-stacking-up-says-jeffrey-gundlach. [Accessed 28/02/2025].